Drive Your Dreams: Unlocking the Road to "Buy Here Pay Here Trucks For Sale"

Drive Your Dreams: Unlocking the Road to "Buy Here Pay Here Trucks For Sale" Typesruckssale.com

The rumble of a powerful engine, the versatility of a spacious bed, the sheer utility a truck brings to daily life – for many, owning a truck isn’t just a desire, it’s a necessity. Whether it’s for work, recreation, or simply navigating demanding terrains, a reliable truck can be an invaluable asset. However, the path to truck ownership often hits a major roadblock for individuals facing credit challenges. Traditional lenders frequently turn away those with less-than-perfect credit scores, leaving many feeling stuck.

But what if there was a viable alternative? A pathway that prioritizes your ability to pay over your past credit history? This is where "Buy Here Pay Here Trucks For Sale" enter the picture. This comprehensive guide is designed to demystify the BHPH process, empower you with knowledge, and help you confidently navigate the market for an affordable, reliable truck. We’ll dive deep into how these dealerships operate, who benefits most, the advantages, potential pitfalls, and crucial tips for securing a great deal and even rebuilding your credit along the way.

Drive Your Dreams: Unlocking the Road to "Buy Here Pay Here Trucks For Sale"

Understanding the Buy Here Pay Here (BHPH) Model: Your Dealer is Your Lender

At its core, the Buy Here Pay Here model represents a unique approach to vehicle financing. Unlike traditional dealerships where you select a vehicle and then apply for a loan through an external bank or credit union, BHPH dealerships handle both the sale and the financing in-house. This means the dealer directly lends you the money to purchase the truck, and you make your payments directly to them.

This integrated approach is precisely what makes BHPH so accessible for a specific segment of buyers. The dealer, acting as the lender, has direct control over the approval process. They’re not beholden to the rigid algorithms and strict credit score requirements of large financial institutions. Instead, their primary focus shifts to your current financial stability and your proven ability to make regular payments.

Who Benefits Most from "Buy Here Pay Here Trucks For Sale"?

The BHPH model isn’t for everyone, but it serves as a crucial financial bridge for specific demographics. If you find yourself in one of the following situations, "Buy Here Pay Here Trucks For Sale" might be your most promising avenue to truck ownership:

- Individuals with Bad Credit History: This is perhaps the most common reason people seek out BHPH options. If you’ve experienced past bankruptcies, repossessions, foreclosures, or have a history of late payments, traditional lenders will likely see you as a high risk. BHPH dealers are far more forgiving of past financial missteps.

- Those with No Credit History: Young adults, recent immigrants, or anyone who hasn’t used credit extensively often fall into the "credit invisible" category. Without a credit history, traditional lenders have no way to assess your reliability, making loan approval difficult. BHPH dealers can be a great starting point to establish your credit.

- Buyers with Low Credit Scores: Even if you have a credit history, a low FICO score can be a significant barrier. BHPH dealerships are often willing to work with scores that traditional banks deem unacceptable, provided you have a stable income.

- Self-Employed or Irregular Income Earners: Proving stable income can be challenging for entrepreneurs, freelancers, or those with seasonal work. BHPH dealers are often more flexible in evaluating non-traditional income sources, such as bank statements or tax returns, rather than just pay stubs.

- Individuals Needing a Truck Urgently: When you need a reliable truck quickly for work or personal reasons, waiting for traditional loan approvals can be impractical. The BHPH process is typically much faster, allowing you to drive away in a truck within a day or two.

The Undeniable Advantages of Choosing BHPH Trucks

While often misunderstood, "Buy Here Pay Here Trucks For Sale" offer several significant advantages, especially for those who have exhausted traditional financing routes. Recognizing these benefits can help you make an informed decision:

- Easier Approval Process: This is the flagship advantage. BHPH dealers focus heavily on your income and job stability rather than solely on your credit score. If you can demonstrate a steady income stream, even if it’s not conventional, your chances of approval are significantly higher. They are looking for your ability to pay now.

- Rapid Approval and Drive-Away Time: Time is often of the essence. Traditional loan applications can take days or even weeks for approval. With BHPH, the financing is done on-site. You can often apply, get approved, and drive off the lot with your new-to-you truck all on the same day. This speed is invaluable when you have an urgent need for transportation.

- Convenience of a One-Stop Shop: Imagine handling everything under one roof: selecting your truck, discussing financing options, and signing all the paperwork. This streamlined process eliminates the need to coordinate between a dealership and a separate financial institution, saving you time and potential headaches.

- A Path to Credit Building (When Done Right): This is a critical, often overlooked benefit. While not all BHPH dealers report to credit bureaus, many reputable ones do. Consistently making your payments on time can significantly improve your credit score over the loan term. This positive payment history can then open doors to better financing options in the future.

- Pro Tip from us: When researching "Buy Here Pay Here Trucks For Sale," always ask potential dealerships if they report customer payment history to the major credit bureaus (Experian, Equifax, TransUnion). This is a non-negotiable factor if your goal is to rebuild credit.

- Access to Reliable Used Trucks: BHPH inventories typically consist of used trucks, which means lower purchase prices compared to new vehicles. This makes truck ownership more accessible and affordable. Dealers often select trucks that are known for their durability and longevity, understanding that their customers rely on these vehicles. You might find a great deal on a well-maintained workhorse.

While "Buy Here Pay Here Trucks For Sale" offer a lifeline, it’s equally important to be aware of the potential drawbacks. Understanding these challenges upfront allows you to approach the purchase with caution and make the smartest choices.

- Higher Interest Rates: This is the most common trade-off. Because BHPH dealers take on higher risk by lending to individuals with poor or no credit, they typically charge higher interest rates (APR) than traditional lenders. These rates can sometimes be significantly higher.

- Common mistake to avoid: Focusing solely on the monthly payment without understanding the total interest paid over the life of the loan. Always ask for the Annual Percentage Rate (APR) and calculate the total cost.

- Limited Vehicle Selection: BHPH lots generally feature an inventory of older, higher-mileage used trucks. While many are perfectly functional and reliable, you might not find the latest models, specific trims, or a wide array of color choices. The focus is on practical, affordable utility.

- Shorter Loan Terms: To mitigate risk and ensure quicker repayment, BHPH loans often have shorter repayment periods compared to traditional loans. While this means you pay off the truck faster, it also translates to higher monthly payments. Ensure your budget can comfortably accommodate these payments.

- Significant Down Payment Requirements: Most BHPH dealerships require a substantial down payment. This serves to reduce the loan amount and demonstrates your commitment to the purchase. While some advertise "no money down," these deals are rare and often come with even higher interest rates.

- Based on my experience: A larger down payment can often lead to more favorable loan terms and lower monthly payments. Saving up for a solid down payment is a wise strategy.

- Potential for Predatory Lenders: Unfortunately, some less reputable dealers operate in the BHPH space. These "bad apples" might engage in deceptive practices, obscure fees, or overly aggressive collection tactics. It’s crucial to thoroughly vet any dealership before committing.

Finding Reputable "Buy Here Pay Here Trucks For Sale" Dealerships

The key to a successful BHPH experience lies in finding a trustworthy and ethical dealer. Not all dealerships are created equal, and your due diligence is paramount.

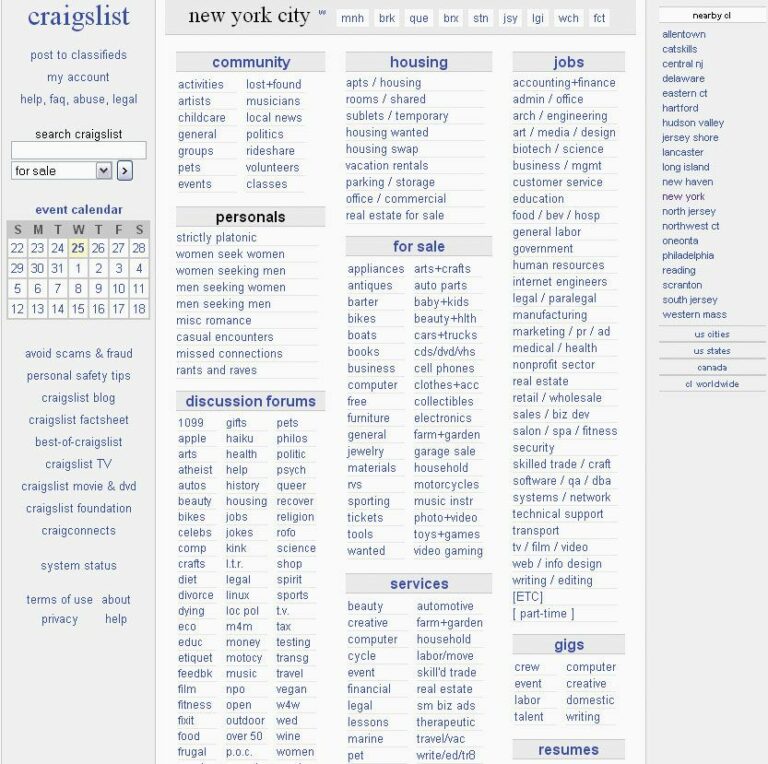

- Online Research and Reviews: Start by searching online for "Buy Here Pay Here Trucks For Sale near me" or "in-house financing trucks ". Pay close attention to customer reviews on Google, Yelp, and the Better Business Bureau (BBB). Look for patterns in feedback regarding customer service, vehicle quality, and transparency.

- Local Recommendations: Ask friends, family, or colleagues who have gone through the BHPH process for their recommendations. Word-of-mouth can be a powerful indicator of a dealer’s reputation.

- Check Their Inventory Online: Before visiting, browse their website to see the types of trucks they offer. This gives you an idea of their pricing, selection, and whether they have vehicles that meet your needs.

- Ask Key Questions During Your Visit:

- Do they report payments to credit bureaus? (Crucial for credit building!)

- What is the exact APR of the loan? (Don’t just accept a monthly payment figure).

- Are there any hidden fees? Ask for a full breakdown of all costs.

- Do they offer any warranty or guarantee on their trucks? Even a limited warranty can provide peace of mind.

- What is their repossession policy? Understand the terms if you were to miss payments.

- Based on my experience: A reputable dealer will be transparent and willing to answer all your questions without pressure. If you feel rushed or that information is being withheld, it’s a red flag.

The Application Process: What to Expect

Applying for a BHPH truck loan is generally straightforward, focusing on your current financial situation. Being prepared can make the process smooth and efficient.

- Required Documents: You’ll typically need to provide:

- Proof of Identity: Valid driver’s license or state ID.

- Proof of Income: Recent pay stubs (usually 2-4), bank statements, tax returns, or benefit letters. The dealer needs to confirm you have a consistent income.

- Proof of Residence: Utility bill, lease agreement, or mortgage statement with your current address.

- References: A list of personal references (not living with you) with their contact information.

- Down Payment: Be ready with the required funds.

- The Interview Process: Expect a brief interview where the dealer will discuss your income, employment history, and living situation. They’re assessing your stability and your ability to make payments consistently.

- Focus on Stability: The more stable your employment and residence, the more confident the dealer will be in your ability to repay the loan.

- Pro Tips: Be honest and upfront about your financial situation. Attempting to obscure information will only complicate the process and damage trust. Having all your documents organized beforehand will also expedite approval.

Key Factors to Consider Before Buying a BHPH Truck

Before you sign on the dotted line for "Buy Here Pay Here Trucks For Sale," a thorough evaluation of several factors is crucial. This will ensure you make a financially sound decision that serves your needs in the long run.

- Your Overall Budget: Don’t just consider the monthly payment. Factor in insurance costs (which can be higher for older vehicles or those with a higher risk profile), fuel expenses, and potential maintenance costs. Remember, used trucks, especially older ones, will eventually require repairs.

- Internal Link: For more insights on managing vehicle expenses, consider reading our guide on "Tips for Maintaining a Used Truck."

- Affordable Down Payment: While a down payment is often required, don’t overextend yourself. Only put down what you can comfortably afford without jeopardizing your emergency savings. A larger down payment can reduce your monthly payments and total interest, but it shouldn’t leave you financially vulnerable.

- Understanding the Interest Rate (APR): As mentioned, BHPH interest rates are higher. Insist on knowing the exact Annual Percentage Rate (APR). This figure reflects the true cost of borrowing, including interest and some fees, over the loan term. Compare the APR to ensure it’s not excessively high, even for a subprime loan.

- Internal Link: To deepen your understanding of how interest rates impact your loan, check out our article on "Understanding Car Loan Interest Rates."

- Loan Terms and Payment Schedule: Shorter terms mean higher payments but less total interest. Longer terms mean lower payments but more total interest. Choose a term that aligns with your budget and financial goals. Also, understand the payment frequency – weekly, bi-weekly, or monthly – and how that fits your income schedule.

- Vehicle Condition and Inspection: This is paramount. Since BHPH trucks are used, their condition varies. Always inspect the truck thoroughly. Look for signs of major accidents, rust, fluid leaks, and listen for unusual engine noises.

- Pro Tip: If possible, take the truck for a pre-purchase inspection (PPI) by an independent, trusted mechanic. This small investment can save you thousands in future repairs. A reputable BHPH dealer should allow this.

- Warranty Options: Ask if the dealership offers any type of warranty, even a limited 30-day or 3,000-mile powertrain warranty. This provides crucial protection against immediate, unforeseen mechanical failures. If no warranty is offered, factor potential repair costs into your budget.

- Credit Reporting Policy: Reiterate this question. If your primary goal is to build credit, ensuring the dealer reports to all three major credit bureaus is absolutely essential. If they don’t, your timely payments won’t help improve your score.

- Common mistake to avoid: Assuming all BHPH dealers report to credit bureaus. Always confirm this in writing.

Making the Most of Your BHPH Truck Purchase: A Credit Building Strategy

Purchasing "Buy Here Pay Here Trucks For Sale" can be more than just acquiring transportation; it can be a powerful tool for financial rehabilitation. Here’s how to maximize this opportunity:

- Pay On Time, Every Time: This is the golden rule. Consistency is key to building a positive payment history. Set up reminders, automate payments if possible, and ensure funds are always available. Each on-time payment reported to credit bureaus is a step towards a better credit score.

- Consider Refinancing Down the Road: Once you’ve established a consistent history of on-time payments (typically 12-18 months), your credit score will likely improve significantly. At this point, you might qualify for a lower interest rate loan from a traditional bank or credit union. Refinancing can save you a substantial amount of money over the remaining loan term.

- Maintain Your Truck Meticulously: A well-maintained truck is a reliable truck. Stick to the manufacturer’s recommended service schedule. Regular oil changes, tire rotations, and prompt attention to minor issues will extend the life of your vehicle and prevent costly major repairs down the line. This also protects your investment.

- Leverage This Opportunity for Future Success: View your BHPH truck loan as a stepping stone. Successfully managing this loan demonstrates financial responsibility, which can positively impact your ability to secure other forms of credit in the future, such as mortgages or personal loans.

- Pro tips from us: Take advantage of free credit monitoring services to track your progress. Understanding how your credit score is calculated (payment history, credit utilization, length of credit history) will empower you to make smarter financial decisions moving forward. For more on building good credit, consult trusted external resources like the Federal Trade Commission’s advice on managing credit and debt.

Conclusion: Your Road to Truck Ownership is Within Reach

The dream of owning a reliable truck doesn’t have to be out of reach, even if your credit history has presented challenges. "Buy Here Pay Here Trucks For Sale" offer a legitimate and often invaluable pathway to truck ownership for thousands of individuals every year. By understanding the unique mechanics of this financing model, recognizing its advantages and potential drawbacks, and diligently researching reputable dealerships, you can make an informed decision that truly benefits you.

Remember, success with BHPH financing hinges on being a proactive and informed consumer. Ask the right questions, understand all terms and conditions, and prioritize your budget and the long-term health of your vehicle and your credit. With careful planning and consistent payments, your BHPH truck can be more than just transportation; it can be a powerful tool to rebuild your financial standing and drive confidently towards a brighter future. Start your research today, and soon you could be driving the truck you need.