Semi Trucks For Sale Low Down Payment

“Navigating the Market: Semi Trucks For Sale Low Down Payment Typestruckssale.com

The dream of owning and operating a semi-truck is a powerful one for many aspiring entrepreneurs and seasoned drivers alike. However, the substantial upfront cost of these massive machines can often be a formidable barrier. This is where the concept of Semi Trucks For Sale Low Down Payment becomes a game-changer. It represents a vital pathway for individuals and small businesses to enter or expand in the lucrative trucking industry without tying up a significant portion of their capital upfront.

In essence, "low down payment" refers to financing options that require a minimal initial cash outlay to secure a semi-truck. This approach dramatically lowers the entry barrier, making truck ownership accessible to a broader range of individuals, including new owner-operators, those looking to upgrade their fleet, or companies aiming to expand their operations without depleting their working capital. The importance of these options cannot be overstated in an industry where cash flow is king and operational flexibility is paramount. This comprehensive guide will delve into every facet of securing semi trucks with a low down payment, offering practical advice, detailing the benefits, outlining the process, and addressing common concerns.

Understanding Low Down Payment Programs for Semi Trucks

The term "low down payment" can be subjective, but in the context of semi-truck financing, it typically refers to down payments ranging from 5% to 15% of the truck’s total purchase price, and sometimes even 0% for highly qualified buyers or specific lease programs. This is a stark contrast to traditional financing that might demand 20% or more upfront.

These programs are designed to mitigate the initial financial burden on buyers. Lenders, dealerships, and specialized financing companies offer these options, often recognizing the strong earning potential of a well-maintained semi-truck and the consistent demand for trucking services. The specific terms of a low down payment program can vary widely based on the lender, the buyer’s creditworthiness, the age and type of the truck, and the overall economic climate. It’s crucial to understand that while the initial cash outlay is reduced, the total cost of the truck over the financing term might be higher due to potentially higher interest rates or longer loan terms.

The Undeniable Benefits of Low Down Payment Options

Opting for Semi Trucks For Sale Low Down Payment financing offers a multitude of advantages that can significantly impact an owner-operator’s or business’s financial health and operational agility:

- Enhanced Cash Flow: The most immediate benefit is preserving working capital. By paying less upfront, businesses can retain more cash for critical operational expenses like fuel, insurance, maintenance, tolls, and driver salaries. This improved liquidity is vital for day-to-day operations and responding to unexpected costs.

- Faster Entry into the Market: A lower down payment means less time spent saving up, allowing aspiring owner-operators to get behind the wheel and start earning sooner. For established businesses, it facilitates quicker fleet expansion to meet growing demand.

- Reduced Financial Risk: While debt is incurred, the initial capital at risk is lower. This can be particularly beneficial for new ventures or during economic uncertainties, offering a buffer against unforeseen market fluctuations.

- Opportunity for Growth: Businesses can acquire multiple trucks or invest in newer, more efficient models with less capital strain, fostering growth and increasing their capacity to take on more lucrative contracts.

- Accessibility for Newbies: For individuals with limited savings but a strong desire to enter the trucking industry, low down payment options provide an accessible entry point that might otherwise be out of reach.

Who Qualifies? Eligibility Criteria for Low Down Payment Semi Trucks

While low down payments make semi-trucks more accessible, lenders still assess a buyer’s ability to repay the loan. Understanding the eligibility criteria is crucial for a successful application. Key factors include:

- Credit Score: A strong personal and business credit score is paramount. Lenders typically look for scores above 650, with higher scores often qualifying for better rates and lower down payments. For newer businesses, personal credit history heavily influences eligibility.

- Time in Business (TIB): Established businesses with a proven track record (typically 2+ years) are often seen as less risky. Newer businesses or startups may still qualify, but might face slightly higher interest rates or require a larger down payment, or a strong business plan.

- Industry Experience: For owner-operators, a clean driving record and substantial experience in the trucking industry (e.g., 2-3 years CDL experience) can significantly strengthen an application.

- Debt-to-Income (DTI) Ratio: Lenders assess your current debt obligations against your income to ensure you can comfortably manage additional payments.

- Business Plan & Financials: For businesses, a solid business plan, along with financial statements (profit & loss, balance sheets), can demonstrate viability and repayment capability.

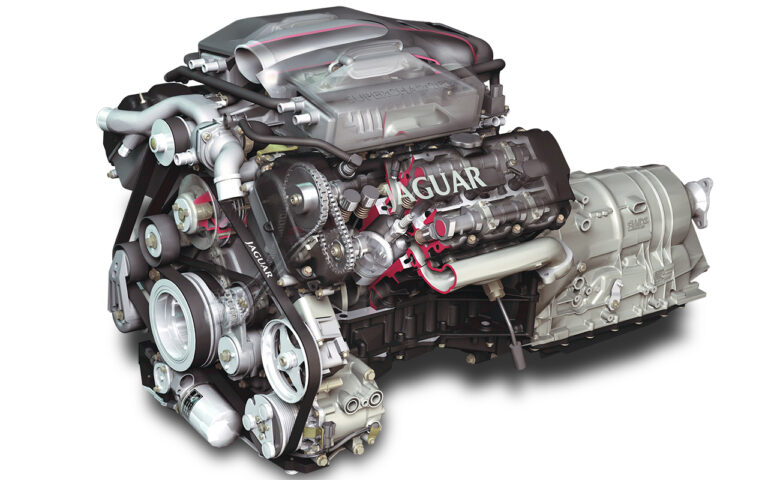

- Collateral: The semi-truck itself serves as collateral. Lenders will evaluate its age, mileage, and condition to ensure it holds sufficient value.

Types of Low Down Payment Financing Options

Several avenues exist for securing Semi Trucks For Sale Low Down Payment:

- Dealership Financing: Many dealerships have in-house financing departments or partnerships with various lenders. They often offer special promotions or programs, sometimes including very low or even 0% down payments for qualified buyers on specific new or used models.

- Specialized Trucking Lenders: These financial institutions focus solely on the transportation industry. They understand the nuances of trucking and may offer more flexible terms, including low down payment options, even for applicants with less-than-perfect credit, albeit often at higher interest rates.

- Lease-to-Own Programs: These programs are popular, especially for new owner-operators. They often require minimal down payments (sometimes just the first and last month’s payment) and provide a path to ownership at the end of the lease term, usually through a balloon payment or buyout option. While offering flexibility, they can sometimes be more expensive overall than traditional loans.

- SBA Loans (Small Business Administration): While not exclusively for low down payments, SBA loans (e.g., SBA 7(a) loan) can have favorable terms, including lower down payment requirements, due to government guarantees. However, they typically involve a more rigorous application process.

- Private Lenders/Brokers: These can be an option for those who struggle with traditional financing, though terms may vary widely, and due diligence is essential to avoid predatory lending practices.

Finding Semi Trucks with Low Down Payment Options

The search for Semi Trucks For Sale Low Down Payment requires a strategic approach:

- Reputable Dealerships: Start with large, established semi-truck dealerships. They often have dedicated financing teams and a wide inventory of both new and used trucks. Inquire specifically about low down payment programs or special financing offers.

- Online Marketplaces & Aggregators: Websites like CommercialTruckTrader.com, TruckPaper.com, and MyLittleSalesman.com list thousands of trucks from various sellers and often include financing options. Filter your search by price range and look for listings that highlight flexible financing.

- Direct Lender Websites: Visit the websites of specialized trucking finance companies. Many have online pre-qualification tools or calculators that can give you an idea of what you might qualify for.

- Trucking Industry Forums & Networks: Engage with online communities or local trucking associations. Experienced owner-operators often share insights on where to find good deals and reliable financing.

- Auctions: While auctions can offer lower purchase prices, finding low down payment financing directly through an auction house is less common. You’ll likely need pre-approved financing from an external lender if you plan to bid.

The Application Process: A Step-by-Step Guide

Securing Semi Trucks For Sale Low Down Payment involves a clear process:

- Assess Your Financials: Before applying, gather all necessary financial documents: personal and business bank statements, tax returns (2-3 years), credit reports, business licenses, and a detailed business plan if applicable.

- Determine Your Budget: Beyond the down payment, consider the total cost of ownership: monthly payments, insurance, maintenance, fuel, and operating expenses. Use online calculators to estimate monthly payments based on various loan amounts, interest rates, and terms.

- Get Pre-Approved: This is a crucial step. Pre-approval from a lender gives you a clear idea of how much you can borrow, the estimated down payment required, and the interest rate. It also strengthens your negotiating position with sellers.

- Find the Right Truck: Once pre-approved, you can confidently shop for a truck within your budget. Conduct a thorough inspection or hire a professional inspector to ensure the truck’s condition matches its price.

- Submit a Formal Application: Provide all requested documentation. Be transparent and accurate. Lenders will conduct a credit check and verify your income and business details.

- Review the Loan Offer: Carefully examine the loan terms, including the down payment amount, interest rate (APR), loan term, monthly payment, and any fees (origination fees, closing costs). Don’t hesitate to ask questions.

- Close the Deal: Once satisfied, sign the financing agreement. The down payment will be made, and the truck will be transferred to your ownership. Ensure all paperwork, including the title and registration, is correctly processed.

Important Considerations Beyond the Down Payment

While a low down payment is attractive, it’s only one piece of the financial puzzle. Overlooking other critical factors can lead to long-term financial strain:

- Interest Rates (APR): A lower down payment often comes with a higher interest rate, increasing the total cost of the loan over time. Compare APRs from multiple lenders.

- Loan Term: Longer loan terms reduce monthly payments but also increase the total interest paid. Balance affordability with the desire to pay off the truck quicker.

- Total Cost of Ownership: Factor in insurance (which can be substantial for semi-trucks), maintenance (routine and unexpected repairs), fuel costs, tires, and potential depreciation.

- Truck Condition & Warranty: For used trucks, a pre-purchase inspection is non-negotiable. Understand any existing warranties or consider purchasing an extended warranty to mitigate future repair costs.

- Hidden Fees: Scrutinize the loan agreement for any origination fees, document fees, or prepayment penalties.

- Insurance Requirements: Lenders will typically require comprehensive insurance coverage, which can be a significant monthly expense. Get quotes before committing to a purchase.

Tips for Securing the Best Deal on Low Down Payment Semi Trucks

To maximize your chances and get the most favorable terms:

- Improve Your Credit Score: Pay down existing debts, dispute inaccuracies on your credit report, and ensure timely payments on all accounts.

- Save a Bit More: Even if a 5% down payment is offered, having 10% or more saved can open doors to better interest rates and demonstrate financial stability.

- Shop Around for Lenders: Don’t settle for the first offer. Compare terms from at least 3-5 different lenders, including dealerships, specialized truck lenders, and banks.

- Be Prepared with Documentation: Having all your financial documents organized and ready will streamline the application process and show you are serious.

- Negotiate: Everything is negotiable – the truck price, interest rate, and even some fees. Use your pre-approval as leverage.

- Consider Used Trucks Wisely: Newer used trucks (2-5 years old) often offer a good balance of lower price, modern features, and remaining useful life, making them ideal for low down payment scenarios.

Potential Challenges and Solutions

While beneficial, pursuing Semi Trucks For Sale Low Down Payment can present challenges:

- Higher Interest Rates:

- Challenge: Lower down payments often mean higher risk for lenders, leading to increased interest rates.

- Solution: Focus on improving your credit score, shop multiple lenders, and if possible, make a slightly larger down payment than the minimum to qualify for better rates.

- Limited Truck Options:

- Challenge: Some low down payment programs might be restricted to specific truck models or older inventory.

- Solution: Be flexible with your truck preferences, or be prepared to