Buy Here Pay Here Semi Trucks For Sale

“Comprehensive Guide to Buy Here Pay Here Semi Trucks For Sale Typestruckssale.com

In the demanding world of commercial trucking, owning a semi truck is often the gateway to financial independence and a thriving business. However, for many aspiring or current truck drivers, traditional financing options can be an insurmountable hurdle, especially when faced with less-than-perfect credit scores, limited credit history, or the challenges of launching a new trucking venture. This is where "Buy Here Pay Here" (BHPH) dealerships for semi trucks step in, offering an alternative path to truck ownership. This comprehensive guide will explore the intricacies of the BHPH model for semi trucks, providing valuable insights, practical advice, and a clear understanding of whether this option is the right fit for your trucking aspirations.

Introduction Comprehensive Guide to Buy Here Pay Here Semi Trucks For Sale

Understanding Buy Here Pay Here (BHPH) for Semi Trucks

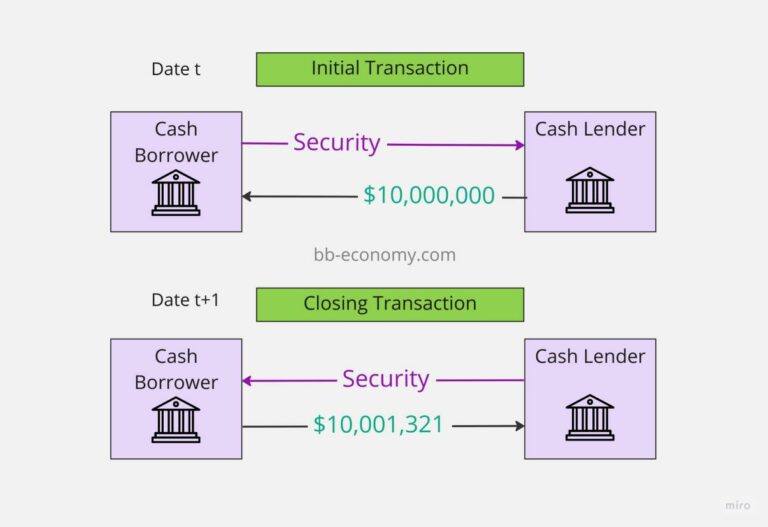

Buy Here Pay Here is a financing model where the dealership itself acts as the lender, providing in-house financing directly to the buyer. Unlike traditional financing through banks or credit unions, BHPH dealerships underwrite their own loans, which allows them to be more flexible with credit requirements. For individuals or small businesses seeking to purchase a semi truck, this often means easier approval, even if they have poor credit, no credit, or have recently faced bankruptcy.

The primary appeal of the BHPH model lies in its accessibility. Traditional lenders often rely heavily on credit scores and extensive financial history, which can exclude many aspiring owner-operators. BHPH dealerships, on the other hand, typically focus more on a buyer’s ability to make regular payments, often verified through proof of income, residence stability, and a substantial down payment. This direct relationship between the buyer and the dealer streamlines the approval process, making it a potentially quicker route to getting behind the wheel of a commercial vehicle.

The Pros of Opting for BHPH Semi Trucks

While often associated with higher costs, the BHPH model for semi trucks offers distinct advantages for specific buyers:

- Accessibility and Easier Approval: This is the most significant benefit. For those with poor credit, no credit history, or who are new to business and lack established financials, BHPH dealerships provide a viable path to securing a semi truck that would otherwise be out of reach through conventional lenders.

- Faster Approval Process: Because the financing is handled in-house, the approval process is typically much quicker than with third-party lenders. This can be crucial for drivers needing to get on the road swiftly to secure contracts or meet deadlines.

- Potential for Credit Building: While not all BHPH dealerships report to credit bureaus, many do. If your payments are reported, consistently making on-time payments can help improve your credit score, paving the way for better financing options in the future. It’s crucial to confirm if the dealer reports payments before signing.

- Immediate Operational Capability: Once approved and the down payment is made, you can often drive off the lot with your semi truck, allowing you to start generating income almost immediately.

- Flexibility (in some cases): While interest rates are generally higher, some BHPH dealers might offer more flexible payment schedules (e.g., weekly or bi-weekly) to align with a truck driver’s income patterns.

The Cons and Important Considerations of BHPH Semi Trucks

Despite the advantages, it’s vital to approach BHPH semi truck purchases with caution and a full understanding of the potential drawbacks:

- Higher Interest Rates: This is the most significant disadvantage. Due to the higher risk associated with lending to buyers with credit challenges, BHPH loans typically come with significantly higher annual percentage rates (APRs) compared to traditional loans. This means you’ll pay substantially more over the life of the loan.

- Higher Down Payments: BHPH dealerships often require larger down payments to mitigate their risk. While this can make the monthly payments slightly lower, it requires a substantial upfront investment.

- Older/Higher Mileage Trucks: The inventory at BHPH dealerships often consists of older, higher-mileage used semi trucks. While these can be more affordable initially, they may come with increased maintenance costs and potential reliability issues.

- Limited Inventory: You’ll likely have fewer choices in terms of makes, models, and specifications compared to dealerships that offer traditional financing or larger commercial truck centers.

- Strict Payment Schedules and Repossession Risks: BHPH contracts are often stringent. Missing even a single payment can quickly lead to repossession, as the dealer retains a direct financial stake in the vehicle.

- Potential for Predatory Practices: While many BHPH dealers are reputable, some may engage in less transparent practices. It’s crucial to scrutinize the contract, understand all fees, and avoid dealers who pressure you into a deal without giving you time to review.

- Lack of Credit Reporting (if applicable): As mentioned, some BHPH dealers do not report payments to credit bureaus. If this is the case, even perfect payment history won’t help you build credit.

Types of Semi Trucks Available via BHPH

BHPH dealerships primarily focus on selling used semi trucks. The inventory will vary widely by dealer and location, but you can typically expect to find:

- Tractor Units: These are the most common, designed to pull various types of trailers. They can range from day cabs (for local or regional hauling) to sleeper cabs (for long-haul routes).

- Common Manufacturers: You’ll frequently encounter trucks from major manufacturers like Freightliner, Peterbilt, Kenworth, Volvo, International, and Mack.

- Age and Mileage: Most BHPH semi trucks will be several years old, often with odometer readings well into the hundreds of thousands of miles (e.g., 400,000+ miles). The age and mileage directly influence the price and potential for future maintenance.

- Condition: The condition will vary significantly. Some trucks might be in decent working order, while others may require immediate repairs. A thorough inspection is paramount.

Purchasing a BHPH semi truck requires careful planning and due diligence. Follow these steps to maximize your chances of a successful and sustainable purchase:

- Thorough Research of Dealerships: Start by identifying reputable BHPH semi truck dealerships. Look for reviews, check their business ratings, and ask for recommendations from other owner-operators.

- Financial Preparedness and Budgeting: Understand your total budget, not just the monthly payment. Factor in the down payment, insurance (commercial truck insurance is expensive), fuel, maintenance, and potential repair costs. Don’t overextend yourself.

- Critical Truck Inspection (Pre-Purchase Inspection is a Must!): Never buy a semi truck, especially a used one from a BHPH lot, without a professional pre-purchase inspection (PPI) by an independent, certified mechanic. This is non-negotiable. A PPI can uncover hidden mechanical issues, engine problems, transmission wear, and other costly defects that might not be apparent during a casual walk-around.

- Understand the Contract: Before signing anything, read the entire contract carefully. Pay close attention to:

- APR (Annual Percentage Rate): This is the true cost of borrowing.

- Total Loan Amount: The total amount you will pay over the life of the loan, including interest.

- Payment Schedule: Weekly, bi-weekly, or monthly payments.

- Fees: Any administrative fees, late payment fees, or other charges.

- Warranty Information: What, if anything, is covered?

- Repossession Clauses: Understand the terms under which the truck can be repossessed.

- Be Prepared for the Down Payment: Have your down payment readily available. A larger down payment can sometimes lead to slightly better terms or lower monthly payments.

- Factor in Commercial Insurance: Obtain insurance quotes before purchasing the truck. Commercial truck insurance is a significant ongoing expense and a legal requirement.

- Negotiate: Don’t assume the price or terms are set in stone. While BHPH dealers have less flexibility than traditional ones, there might still be room to negotiate the price of the truck, the down payment, or even the interest rate slightly.

Tips for Success with a BHPH Semi Truck

Once you’ve acquired your BHPH semi truck, success hinges on disciplined financial management and diligent vehicle maintenance:

- Prioritize Payments: Make your truck payments your top financial priority. Missing payments can quickly lead to repossession and severe financial consequences.

- Strict Maintenance Schedule: Older trucks require more frequent and thorough maintenance. Stick to a strict preventive maintenance schedule to avoid costly breakdowns on the road.

- Build an Emergency Fund: Set aside funds specifically for unexpected repairs, tire blowouts, or periods of lower income. This is crucial for owner-operators.

- Communicate with the Dealer: If you anticipate a problem making a payment, communicate with the dealership before the due date. Some may be willing to work with you on a temporary solution.

- Understand Your Truck’s Limitations: Know the age, mileage, and condition of your truck. Don’t overload it or push it beyond its capabilities, as this can lead to premature wear and expensive repairs.

- Look to Refinance: Once your credit improves (if payments are reported) and you’ve established a consistent payment history, explore options to refinance your BHPH loan with a traditional lender at a lower interest rate.

Challenges and Solutions

| Challenge | Solution |

|---|---|

| High Interest Rates | Focus on paying down the principal faster if possible; look to refinance with a traditional lender once your credit improves. |

| Potential Mechanical Issues (Older Trucks) | Mandatory Pre-Purchase Inspection (PPI); set aside a dedicated maintenance and emergency repair fund; adhere to strict preventive maintenance schedules. |

| Limited Inventory Choices | Be patient; expand your search radius; consider the "best available" truck that meets your needs rather than holding out for a specific model. |

| Strict Payment Terms & Repossession Risk | Implement rigorous budgeting; ensure consistent income; maintain an emergency fund; communicate proactively with the dealer if issues arise. |

| Lack of Credit Reporting | Confirm with the dealer if they report to credit bureaus before signing; if not, focus on building credit through other means (e.g., secured credit cards) while maintaining truck payments. |

| High Down Payment Requirement | Save aggressively; explore all available personal or business loan options to fund the down payment if necessary, but be wary of adding more debt. |

Estimated Price Range for Buy Here Pay Here Semi Trucks

It’s crucial to understand that prices for BHPH semi trucks can vary wildly based on the truck’s make, model, year, mileage, condition, the specific dealer, and the buyer’s financial situation. The following table provides estimated ranges to give you a general idea, but these are not fixed prices and actual costs will differ significantly. Always get a detailed quote directly from the dealership.

| Truck Type/Make (Used) | Year Range (Est.) | Typical Odometer (Miles) | Estimated Down Payment Range | Estimated Monthly Payment Range (36-60 mo. term) |

|---|---|---|---|---|

| Freightliner Cascadia | 2012-2018 | 500,000 – 800,000+ | $5,000 – $15,000+ | $1,500 – $3,000+ |

| Peterbilt 379/389 | 2008-2016 | 600,000 – 900,000+ | $7,000 – $20,000+ | $1,800 – $3,500+ |

| Kenworth T680/W900 | 2012-2018 | 550,000 – 850,000+ | $6,000 – $18,000+ | $1,700 – $3,300+ |

| Volvo VNL | 2010-2017 | 500,000 – 800,000+ | $4,000 – $12,000+ | $1,400 – $2,800+ |