Bank Repo Tow Trucks Sale: Your Comprehensive Guide to Smart Acquisitions

Bank Repo Tow Trucks Sale: Your Comprehensive Guide to Smart Acquisitions typestruckssale.com

In the demanding world of towing, roadside assistance, and vehicle recovery, having reliable equipment is paramount. However, acquiring a new tow truck can represent a substantial capital investment, often stretching into six figures. This is where the often-overlooked market of Bank Repo Tow Trucks Sale emerges as a compelling alternative. These are commercial vehicles, including everything from light-duty wreckers to heavy-duty rotators, that have been repossessed by banks or financial institutions due to loan defaults. For the savvy buyer, these sales represent a unique opportunity to acquire high-value assets at a significantly reduced cost, providing a strategic advantage for businesses looking to expand their fleet or individuals entering the industry.

This comprehensive guide will delve into the intricacies of bank repo tow truck sales, offering insights into their benefits, the acquisition process, crucial considerations, and actionable advice to help you navigate this specialized market successfully.

Bank Repo Tow Trucks Sale: Your Comprehensive Guide to Smart Acquisitions

The Anatomy of a Bank Repossession: Why These Trucks are Available

When an individual or business defaults on a loan secured by a vehicle, the lending institution has the right to repossess that asset to recover their losses. Banks and credit unions are not in the business of owning or operating tow trucks; their primary goal is to liquidate these repossessed assets as quickly and efficiently as possible to minimize financial exposure. This urgency often translates into competitive pricing designed to attract buyers and move inventory swiftly.

The reasons for default can vary widely, from economic downturns affecting a business to unforeseen personal financial hardship. Importantly, a repossession does not necessarily imply a flaw in the vehicle itself. While some repossessed trucks might have been neglected, many are simply collateral that the previous owner could no longer afford, making them potentially excellent deals for the next owner.

Unlocking Value: The Benefits of Buying Repo Tow Trucks

The allure of bank repo tow trucks lies primarily in the potential for substantial savings, but the advantages extend beyond just price:

- Significant Cost Savings: The most obvious benefit. Repo trucks are typically sold at a fraction of the cost of new models and often well below market value for comparable used vehicles. This immediate reduction in capital outlay frees up funds for other business operations or necessary repairs.

- Access to High-Value Equipment: Tow trucks, especially heavy-duty models, are specialized and expensive pieces of machinery. Bank repo sales democratize access to this equipment, allowing smaller businesses or startups to acquire assets that might otherwise be out of reach.

- Quick Acquisition: Unlike ordering a new truck, which can involve long lead times for manufacturing and customization, repo trucks are available immediately. This can be crucial for businesses needing to expand their fleet rapidly to meet demand.

- Variety of Options: The repo market offers a diverse range of makes, models, capacities, and configurations. You might find anything from a basic rollback to a sophisticated rotator, allowing you to select a truck that precisely fits your operational needs.

- Potential for Profit/Value Addition: For buyers with mechanical skills or access to affordable repair services, a repo truck needing minor work can be transformed into a highly profitable asset. Investing a small amount in reconditioning can significantly increase its operational value and resale potential.

Your Hunting Ground: Where to Find Bank Repo Tow Trucks

Knowing where to look is the first step in securing a great deal. The bank repo market isn’t a single storefront; it’s a network of channels:

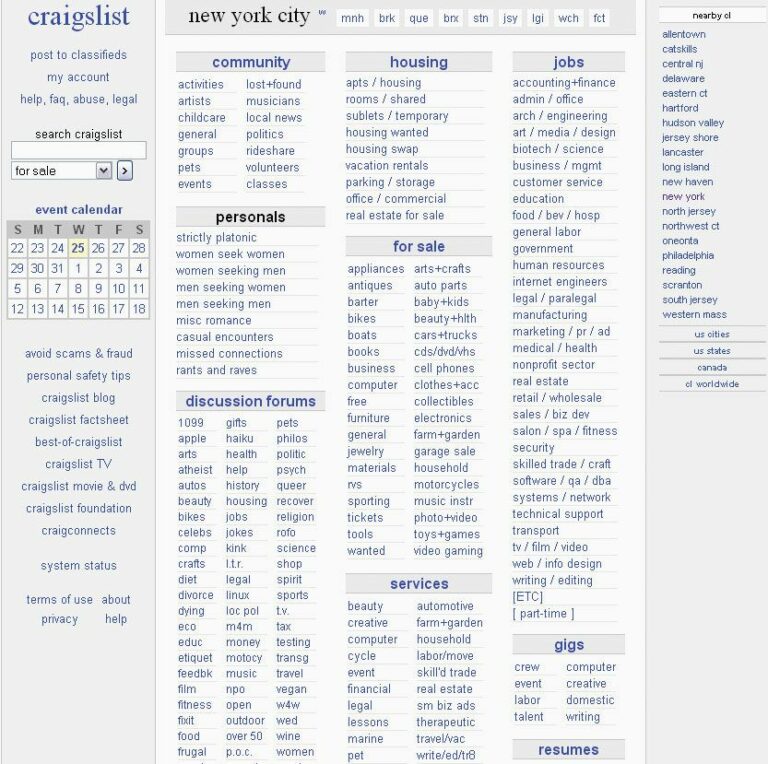

- Online Auction Platforms: These are perhaps the most popular avenues. Websites like GovPlanet, Ritchie Bros. Auctioneers, IronPlanet, and various local auction houses (often affiliated with banks or repo companies) frequently list commercial vehicles, including tow trucks. These platforms offer detailed listings, photos, and sometimes inspection reports.

- Direct from Banks/Credit Unions: While less common for individual tow truck sales, some larger financial institutions maintain their own "repo lists" or dedicated sales departments. It’s worth checking the websites of major banks or contacting their asset recovery divisions.

- Specialized Repo Dealers/Brokers: Many dealerships specialize in acquiring repossessed vehicles in bulk from banks and then selling them to the public. These dealers often recondition the vehicles to some extent and might offer limited warranties, though prices might be slightly higher than direct auctions.

- Local Auto Auctions: Public auctions, especially those with a commercial vehicle section, can be a good source. These auctions might require on-site attendance for bidding but offer the advantage of direct physical inspection.

- Government Surplus Auctions: Occasionally, government agencies (federal, state, or municipal) may auction off their retired or surplus tow trucks, which can sometimes be repossessed vehicles or those acquired through legal forfeiture.

The Due Diligence Checklist: What to Inspect Before You Buy

While the savings are attractive, buying a repo tow truck is not without risks. Most sales are "as-is, where-is," meaning no warranties and no returns. Thorough due diligence is paramount:

- Comprehensive Physical Inspection: This is non-negotiable.

- Exterior: Check for significant body damage, rust, frame integrity, tire wear, and signs of accidents.

- Interior: Assess the condition of the cabin, seats, dashboard, and electrical components.

- Undercarriage: Look for leaks (oil, transmission, hydraulic fluid), bent components, or excessive rust.

- Mechanical Assessment:

- Engine & Transmission: Listen for unusual noises, check fluid levels, and look for smoke. If possible, test drive the truck to assess shifting, braking, and steering.

- Hydraulic System: Test the boom, winch, and outriggers for smooth operation, leaks, and full functionality.

- Electrical System: Ensure all lights, gauges, and auxiliary equipment work correctly.

- Brakes: Check for responsiveness and any unusual sounds.

- Professional Inspection: If you’re serious about a particular truck, strongly consider hiring an independent, qualified mechanic specializing in heavy vehicles to perform a pre-purchase inspection. This small investment can save you from costly post-purchase surprises.

- Title and Documentation: Verify that the title is clear, free of liens, and transferable. Check the VIN (Vehicle Identification Number) against the documentation and run a vehicle history report (e.g., Carfax, AutoCheck) if available, though commercial vehicle histories can be less comprehensive.

- Hidden Costs: Factor in potential costs beyond the purchase price:

- Auction fees/buyer’s premium (can be 10-15% of the sale price).

- Sales tax and registration fees.

- Transportation costs if the truck is far away.

- Immediate repairs, maintenance, and reconditioning.

- Insurance.

Understanding the Fleet: Types of Repo Tow Trucks Available

The diversity of tow trucks means you’ll find various types on the repo market, each suited for different tasks:

- Light-Duty Wreckers: Designed for cars, motorcycles, and small SUVs. Often found on 1-ton chassis.

- Medium-Duty Wreckers: Capable of towing larger SUVs, pickup trucks, and light commercial vehicles. Built on 2-ton to 4-ton chassis.

- Heavy-Duty Wreckers (Rotators/Integrated): The behemoths of the towing world, used for semi-trucks, buses, RVs, and heavy equipment. These are the most expensive new and can offer the greatest savings as repo units.

- Flatbed/Rollback Trucks: These trucks have a hydraulic bed that tilts and slides back to load vehicles. Ideal for transporting all-wheel-drive vehicles, exotic cars, or forklifts safely.

- Integrated Tow Trucks: Combine the boom and wheel lift into a single unit, offering compactness and maneuverability, often used for quick city tows.

Master the Deal: Practical Tips for a Successful Purchase

Navigating the bank repo market requires a strategic approach:

- Set a Realistic Budget (and Stick to It): Determine your maximum bid, including all potential hidden costs, and do not exceed it. Emotional bidding at auctions can lead to overpaying.

- Do Your Homework: Research comparable trucks (both repo and standard used market) to understand fair market value. This helps you identify genuine deals.

- Be Patient: The right truck might not appear immediately. Keep monitoring auction sites and listings regularly.

- Leverage Professional Help: As mentioned, a mechanic’s inspection is invaluable. If you’re new to auctions, consider attending a few as an observer to understand the process before bidding.

- Read the Fine Print: Always review the terms and conditions of the sale carefully, especially regarding payment deadlines, pickup arrangements, and "as-is" clauses.

- Factor in Reconditioning: Assume the truck will need some work. Budget for new tires, fluid changes, filter replacements, and any identified repairs.

While rewarding, buying repo tow trucks comes with specific challenges:

- Lack of Maintenance History: This is perhaps the biggest hurdle. Repossessed vehicles rarely come with detailed service records. Solution: Rely heavily on a thorough pre-purchase inspection by a trusted mechanic. Assume the worst and budget accordingly for potential repairs.

- "As-Is, Where-Is" Sales: Most repo sales offer no warranties or guarantees. Solution: Understand that once you buy it, it’s yours, flaws and all. This reinforces the need for meticulous inspection and realistic expectations.

- Unknown Mechanical Condition: While you can inspect, you can’t always predict every future issue. Solution: Budget a contingency fund specifically for unexpected repairs in the first few months of ownership.

- Competitive Bidding: Popular models or trucks in excellent condition can attract many bidders, driving up prices. Solution: Set your maximum bid beforehand and be prepared to walk away if the price exceeds your comfort zone.

- Transportation Logistics: If you buy a non-running or distant truck, you’ll need to arrange transportation. Solution: Research transport costs in advance and factor them into your budget.

Pricing Guide: Estimated Costs and Key Influencers for Bank Repo Tow Trucks

It’s crucial to understand that prices for bank repo tow trucks vary significantly based on numerous factors. The table below provides estimated ranges and the primary influences on pricing, rather than exact figures which are impossible to predict.

| Category/Type of Tow Truck | Estimated Repo Price Range (USD) | Typical Used Market Price Range (USD) | Key Factors Influencing Price | Additional Costs to Budget For (Beyond Purchase Price) |

|---|